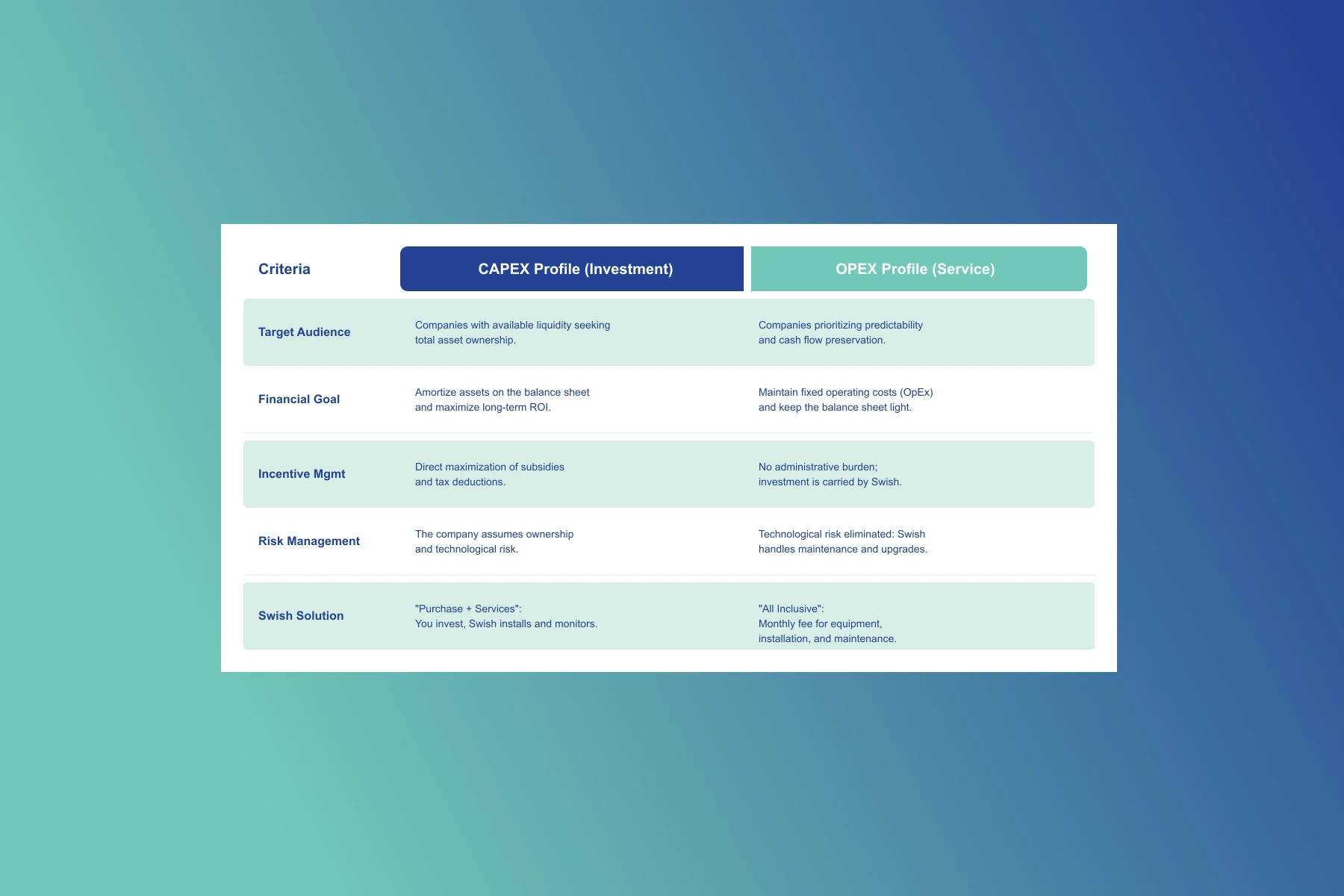

The transition to electric mobility is not just a technical challenge; it is a strategic financial decision.

In the current landscape, there is no single "right" way to approach the investment. At Swish, we adapt to your cash flow strategy. What remains constant is simplicity. Whether you choose to buy the asset (CapEx) or subscribe to the service (OpEx), Swish acts as your single strategic partner.

OpEx Model: Liquidity Preservation with No Financial Risk

At Swish, we don't just act as a supplier, but as an investing partner. We cover 100% of the project costs—from the site survey and civil works to high-power equipment. We transform an uncertain CAPEX into a predictable, tax-deductible OPEX.

Why is our OPEX model unique on the market?

Revenue Sharing

We share a portion of the margin generated by every public or semi-public charging session with you. Your infrastructure stops being a cost center and becomes a new stream of ancillary revenue from month one.

Guaranteed Final Ownership

At the end of the agreed term, full ownership of the installation transfers to your company. You enjoy cutting-edge technology today without obsolescence risk and capitalize on the asset tomorrow when the market has matured.

Zero Operational Risk

As asset owners during the contract, the performance responsibility is ours. We handle energy procurement, incident management, and comprehensive maintenance.

CAPEX Model: Asset Acquisition and Total Control

If your financial strategy prioritizes asset acquisition and balance sheet depreciation, the CAPEX model is your route. With Swish, you convert the infrastructure purchase into a "turnkey" project without technical hassles.

Your Advantages in the Direct Investment Model

Immediate Asset Ownership

Incorporate the charging infrastructure into your balance sheet, depreciate the investment according to your accounting policies, and maintain absolute control over future asset management.

ROI Maximization via Incentives

By funding the initial investment, your company is the direct beneficiary of subsidies. Government grants can cover a significant percentage of eligible costs, drastically reduce your Net CapEx and accelerate the break-even point.

"Turnkey" Execution by Swish

We act as your comprehensive engineering department: we perform the site survey, design, civil works, installation, and permitting.

Investment Transparency

We know budget is critical. That's why we offer total transparency regarding hardware and installation cost ranges.

Financial Engineering: Reduce Your Investment by up to 40%

Comprehensive Project Coverage

We manage subsidies that can cover up to 40% of eligible costs. This includes civil works, engineering, and project management, drastically reducing your Net CapEx.

End-to-End Management

Our legal department handles the entire subsidy lifecycle: from the initial application to the final technical justification required by the administration.

Strategic Opportunity Window

These funds are limited. Waiting for natural market price parity means foregoing government capital that is guaranteed today but may run out tomorrow. The opportunity cost of waiting exceeds the cost of transition.

Decision Matrix: Which model fits your priorities?

Contact us and adapt financing to your treasury strategy

OpEx Model: No Upfront Investment

Preserve your cash flow and eliminate technical risk. We assume 100% of the investment (hardware and civil works) and operations, transforming the project into a deductible monthly service fee.

CapEx Model with Maximized Returns

If you prefer to add the asset to your balance sheet, we fully manage Plan MOVES III grants to cover up to 40% of costs, drastically reducing your net financial outlay.

Shared Profitability (Revenue Share)

Turn a cost center into a revenue stream. Under our service model, we share the margin generated from public charging with you, monetizing your infrastructure from month one.